The idea of living for less is becoming increasingly appealing to people who want to stretch their money even further. The median listing price for single-family homes, condominiums, townhomes, and co-ops in December of 2020 was $340,000, up 13.4 percent compared to last year, according to Realtor.com.[1]

A significant price increase is a great sign for sellers but a potential roadblock for some first-time homebuyers lacking abundant funds for a down payment. FHA loans are popular among first-time homebuyers because they only require a 3.5% minimum down payment. Their credit score requirements aren’t as strict, either. Younger homebuyers often favor this program because it offers a cheaper alternative to a conventional loan. FHA loans can be used to buy manufactured homes, modular homes, single-family homes and condominiums.

Manufactured homes provide an alternative to buying a single-family suburban home or condominium and offer a relatively affordable path to homeownership.

According to the Manufactured Housing Institute, an estimated 22 million people live in manufactured housing. Ninety percent of those people are satisfied with their homes.[2]

In this article, we’ll take a closer look at the FHA manufactured home loan requirements, as well as what it takes to obtain one.

FHA Manufactured homes are built in factories and adhere to construction and safety standards set by the U.S. Department of Housing and Urban Development, or HUD.

Manufactured homes must meet specific property condition requirements to be eligible for purchase with an FHA loan, including:

The Department of Housing and Urban Development (HUD) offers loan programs for manufactured homes through the Federal Housing Administration loan program, including Title I and Title II loans.

FHA Title I loans are fixed-rate loans made for home improvements, repairs, and buying manufactured homes even if the buyer does not own or plan to buy the land the home occupies. They do come with loan amount and term limits as outlined by HUD below:

FHA Title I Maximum Loan Amounts

FHA Title I Maximum Loan Term

FHA Title II loans are fixed-rate loans made for financing manufactured homes and land sold together, above the Title I loan amount and term limits. Title II loans fall under FHA’s national conforming loan limits for Single-Family homes. The maximum loan amount is $524,225 as of 2025 and $541,287 in 2026 and adjusts annually. Loan term options for Title II loans are 15 and 30 years.

Manufactured homes were once called and referred to as mobile homes. Some people may still refer to manufactured homes as mobile even if the home isn’t technically mobile.

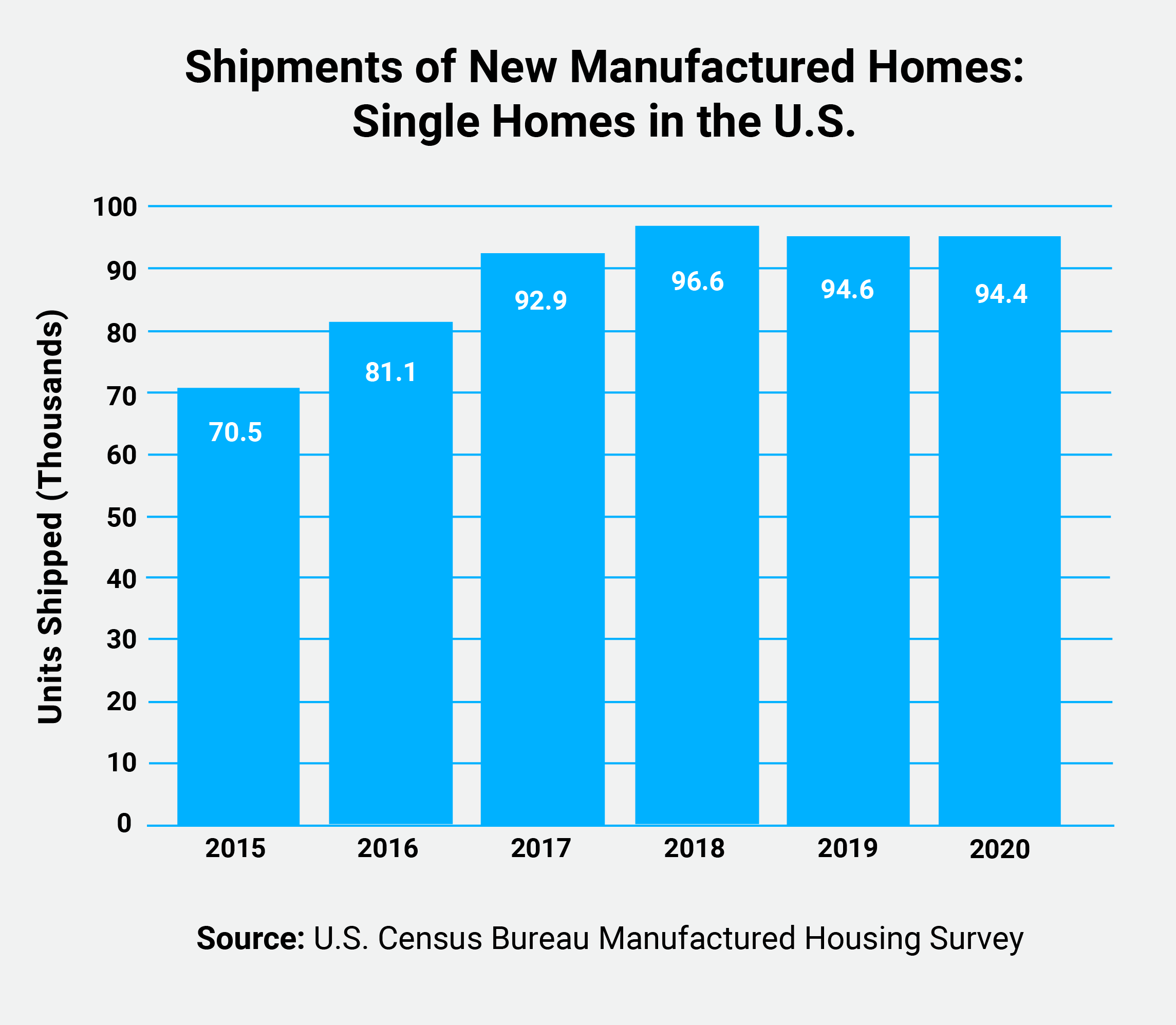

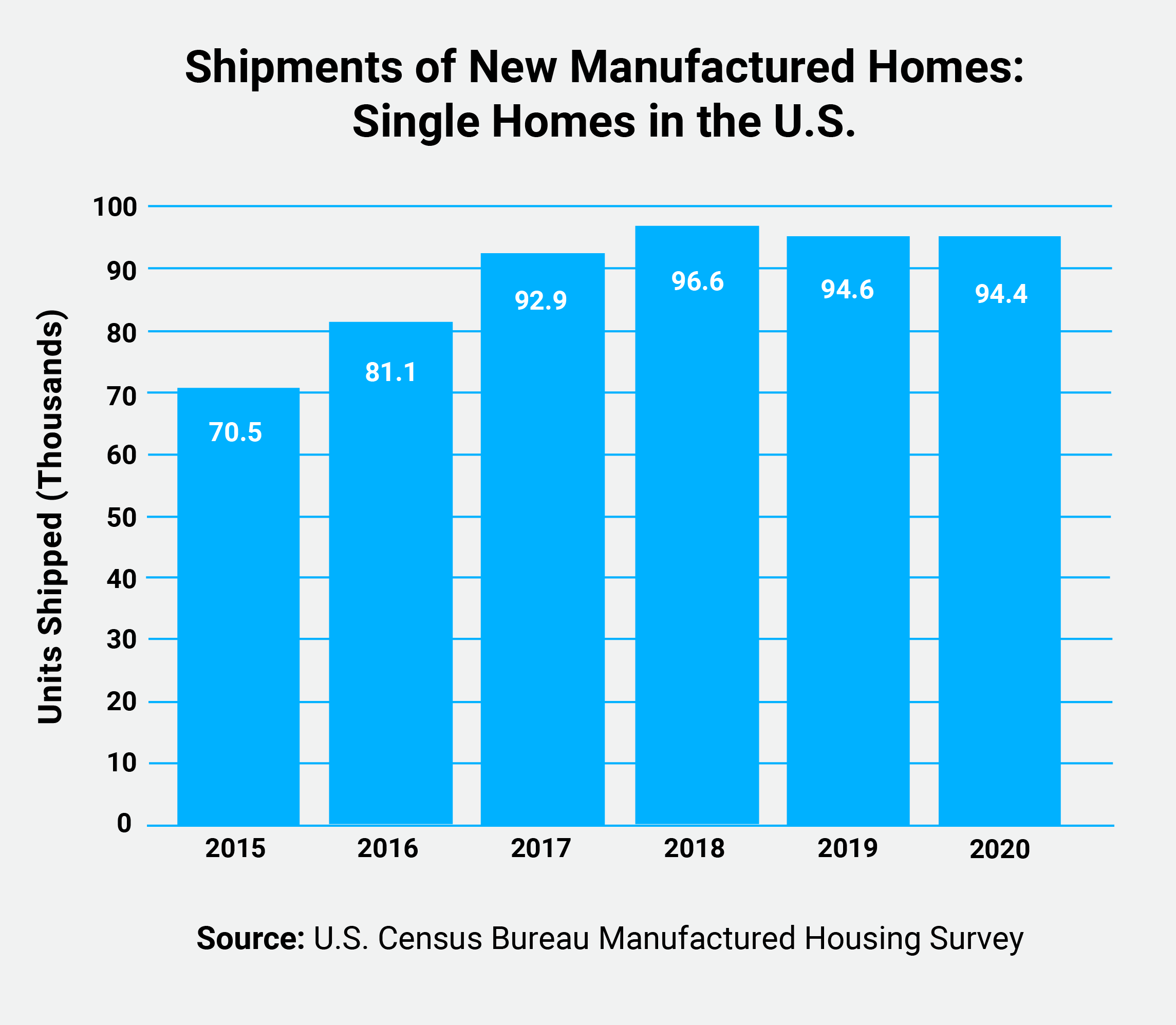

Newly released data from the U.S. Census Bureau shows that the number of manufactured homes being shipped in the U.S is increasing every year.[3]

Their findings suggest that more and more homeowners are deciding to go the non-traditional route for housing.

Here’s the most recent snapshot of the Current Manufactured Housing Survey from October of last year showing the number of manufactured homes shipped in the United States.

| Latest Data | Totals |

|---|---|

| Average Sales Price | $89,400 |

| Total Shipped (thousands of units) | 9,000 |

| Sold and Placed for Residential Use | 6,100 |

| Intended Sale for Residential Use | 2,900 |

| For Non-Residential of Other Use | Z |

In the last 5 years, the number of new manufactured homes being shipped grew 33.9%.

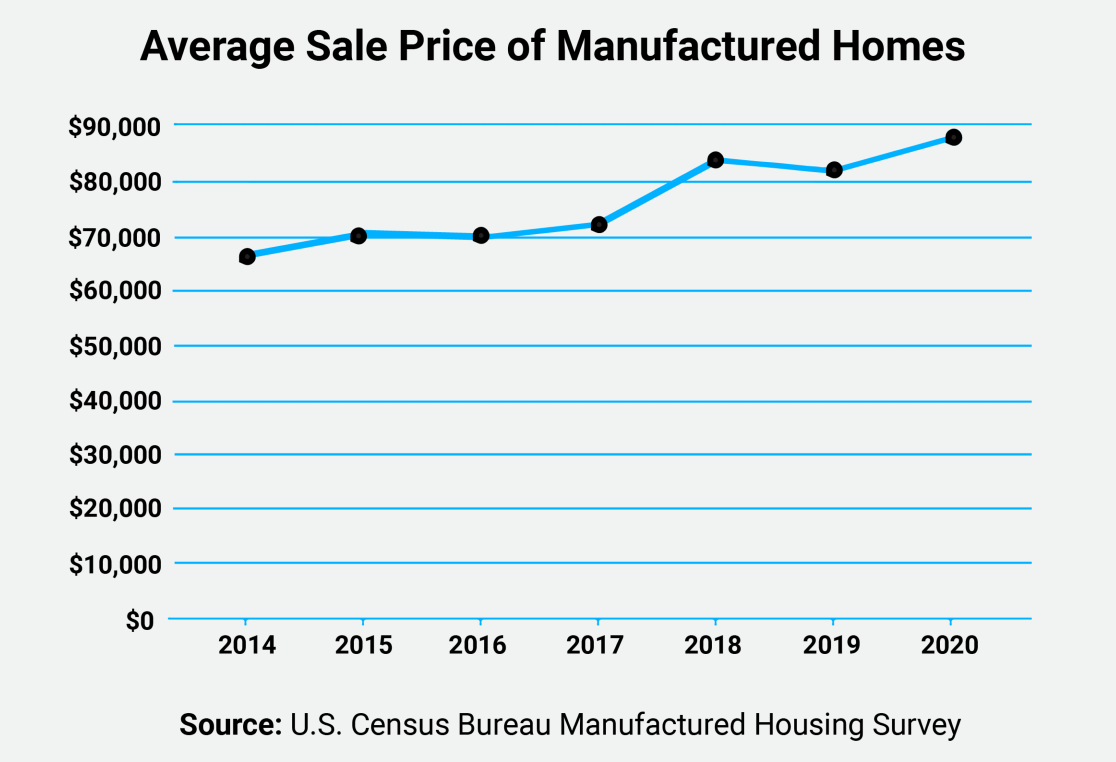

Here’s a breakdown of the average sale price of manufactured homes being sold over the last five years. The average sale price of a manufactured home last year was a little over $87,000. If you were to compare this to the cost of buying a traditional home, that’s roughly $250,000 in savings.

The number of new manufactured homes in the U.S. is continuously growing, so there’s no denying the increased demand for efficient, affordable housing. When shopping for a home, you’ll more than likely be very budget-conscious.

Some of the advantages to buying a manufactured home instead of a traditional stick-built house include:

If you still have questions, or you’re unsure if purchasing a manufactured home is the best option for you, don’t hesitate to speak with an FHA-approved lender to discuss your options.

Sources